This article serves as an overview of the key developments in ComReg’s proposed “Multi-Band Spectrum Award”. Please note that the details discussed are subject to change as the consultation process is ongoing and a draft Information Memorandum is expected in the spring of this year.

Spectrum is the perennial lifeblood of the wireless industry. This is a tale as true today as it was in the early days of the first mobile networks. The cyclical shifts from one generation of cellular to the next have been driven by progressively tapping a wider array of spectrum assets and making that process more efficient.

On the cusp of a multi-year transition to 5G NR and, of course, continued advancement of 4G LTE, the insatiable demand for licensed spectrum in low, mid and high-bands persists. This demand for spectrum is directly proportional to the traffic demands placed on mobile networks, which are poised to accelerate with new applications and use cases.

In Ireland, the Commission for Communications Regulation (ComReg) is engaged in facilitating a landmark multi-band award process that is intended to make 350 MHz of licensed spectrum available across the 700, 2300 and 2600 MHz bands.

Understanding the Dynamics of the Irish Market.

The gravity of the upcoming auction cannot be underestimated when examined in the context of the wireless market in Ireland. Upon completion, it will represent one of the most significant assignments of licensed spectrum in living memory. This will be especially transformative for a market that has, historically, suffered from a chronic lack of spectrum.

Irish mobile operators, wireless Internet service providers (WISPs) and neutral hosts have all expressed interest to partake in the auction process. While each will desire different portions of the spectrum on offer, the important commonality is that virtually every operator is now seeking access to further mid and high-band assets for capacity augmentation.

The allure of spectrum in the 2300 and 2600 MHz bands, for example, stems from the acceleration of mobile data traffic growth in the Irish market, with a year-on-year increase of 56.6% reported by ComReg in the last quarter[1].

This mesmerising growth can be attributed to several factors including the proliferation of low cost and unlimited data allowances, and the renewed expansion of infill 4G LTE network coverage in suburban and rural markets.

The 3.6 GHz band has enabled 5G NR commercialisation in Ireland.

Each of Ireland’s three mobile operators, Vodafone, Three, and eir, is now engaged in an overlay macrocell deployment of 5G NR in the 3.6 GHz band. Thanks to co-location on existing 4G LTE sites in suburban and urban markets, along with the non-standalone architecture (NSA) of 5G being employed, a rapid rollout can be delivered.

Both Vodafone and eir have boasted gigabit downlink speeds on their respective commercial 5G networks, with coverage available across parts of Ireland’s six cities and across a number of large towns. The mobile operators have adopted a premium pricing strategy in an effort to monetise the performance gains.

This has been made possible by ComReg’s release of 350 MHz of TDD spectrum in the 3.6 GHz band in 2017. The auction resulted in five winning bidders, including neutral host provider Dense Air (Airspan) and fixed wireless access provider Imagine. Notably, it was one of only two auctions for licensed access spectrum in the last decade in Ireland.

The 700 MHz Band: Democratising the next generation of cellular.

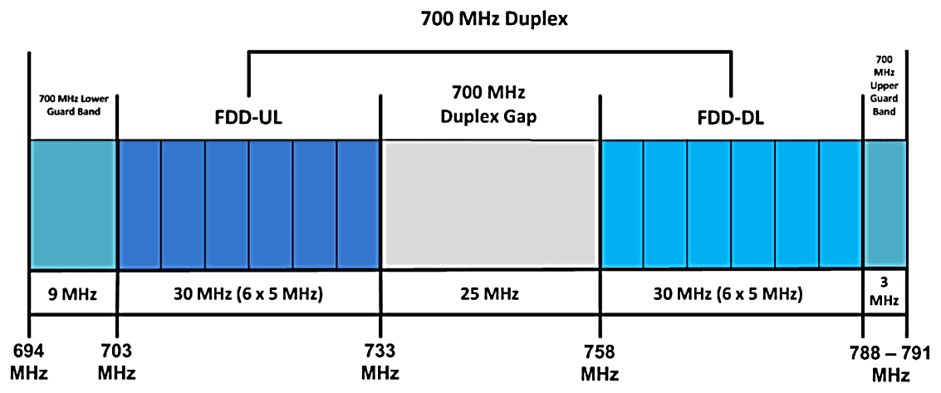

Image courtesy of ComReg 19/59R

Identified as a “pioneer” medium for 5G deployments across Europe, the 700 MHz band will play an integral role in democratising access to the next generation of wireless networks. Spectrum in this low-band exhibits very favourable propagation characteristics, making significant geographical and indoor coverage expansion viable.

When juxtaposed with the other bands set to be on offer in this and upcoming spectrum auctions, 700 MHz is unique as a “low-band”. This is one of the primary reasons why operators are likely to attach a high value to it. Upon release and deployment, it will join the existing 800 (4G LTE) and 900 MHz (3G) bands in providing low-capacity data coverage across vast swathes of rural lands.

Historically, the 700 MHz band has been used for the purpose of serving Digital Terrestrial Television (DTT) services in Ireland. The state-owned public broadcaster, RTÉ, has been tasked with vacating the band by March of this year, bringing the total amount of fallow contiguous spectrum to 96 MHz.

ComReg, however, intends only to release 2×30 MHz of spectrum in the 700 MHz Duplex. This particular portion of the band is composed of 703-733 MHz (FDD uplink) paired with 758-788 MHz (FDD downlink). The other portions of the band (namely the Duplex Gap and Guard Bands) will remain unused, due in part to the current lack of device support.

Given the suitability of this band to support cost-effective mobile network expansion in rural and underserved parts of Ireland, ComReg intends to attach coverage obligations to 700MHz licenses. These obligations are defined as “precautionary in nature, and are towards the upper end of the range of commercially realistic competitive outcomes”.

Existing mobile operators that purchase 2×10 MHz of spectrum or more in the band will be required to provide 95% population coverage (with cell-edge downlink rates of >30Mbps) and 92% geographic area coverage (with cell-edge downlink rates of >3Mbps) within seven years.

In addition to these obligations, there will also be a requirement to provide coverage (30Mbps outdoor throughput) to hundreds of specific locations across Ireland within a similar timeframe. These locations include visitor attractions, transport and business hubs, as well as hospitals and higher education campuses.

The 2300 and 2600 MHz Bands: Enhancing 4G LTE and 5G NR network capacity.

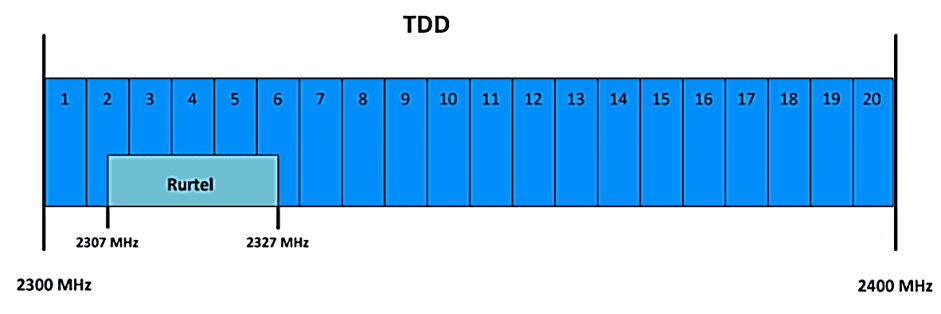

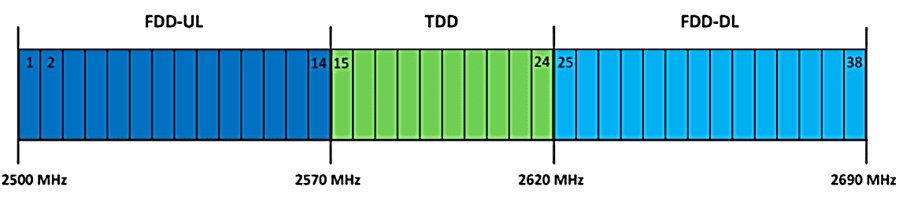

Image courtesy of ComReg 19/59R

Capacity bands are carrying an increasingly high proportion of data traffic on the Radio Access Network (RAN). This trend will continue as mobile operators seek to densify their site grid and improve indoor signal quality with small cell solutions. The wide channel bandwidth offered by these bands delivers the exceptional leap in network performance promised by 5G NR.

In the upcoming multi-band award, ComReg plans to release spectrum in the 2300 and 2600 MHz bands. There is 100 MHz of TDD spectrum available in the 2300 MHz band (2300-2400 MHz), and this has been largely unused across most of the Irish landmass for some time now.

The incumbent user of the 2300 MHz band, eir, provides a point-to-multipoint system for fixed voice services (RurTel) in a small number of rural areas under a Universal Service Obligation (USO).

Upon completion of the award process, Irish operators and consumers will join those in other European countries such as the United Kingdom and Denmark in tapping the 2300 MHz band for 4G LTE. Thanks to the pervasive deployment of the band across Asia, there is a healthy device and equipment ecosystem already in place to take advantage of it.

Spectrum in the 2600 MHz band, meanwhile, has been fallow since the termination of the Multichannel Multipoint Distribution System (MMDS) in 2016. This former incumbent use enabled the retransmission of television services in Ireland. The band consists of 190 MHz of spectrum (2500–2690 MHz) divided into the 2.6 GHz FDD Duplex (2×70 MHz) and the 2.6 GHz Duplex Gap (50 MHz unpaired).

Mobile operators, in particular, have described that there is “pent-up” demand for the 2600 MHz band in Ireland given the current shortage of mid and high-band spectrum assets. A rapid rollout of the band in congestion-stricken urban areas is likely as a very mature device and equipment ecosystem exists today.

While some coverage and deployment obligations will apply to these bands in the award, they will be significantly less stringent than those levied on the 700 MHz band. The less favourable signal propagation characteristics and higher path loss cannot be fully compensated for, even with the exploitation of techniques such as beamforming (which nets higher antenna gain).

The 2100 MHz Band: Complex Liberalisation Awaits.

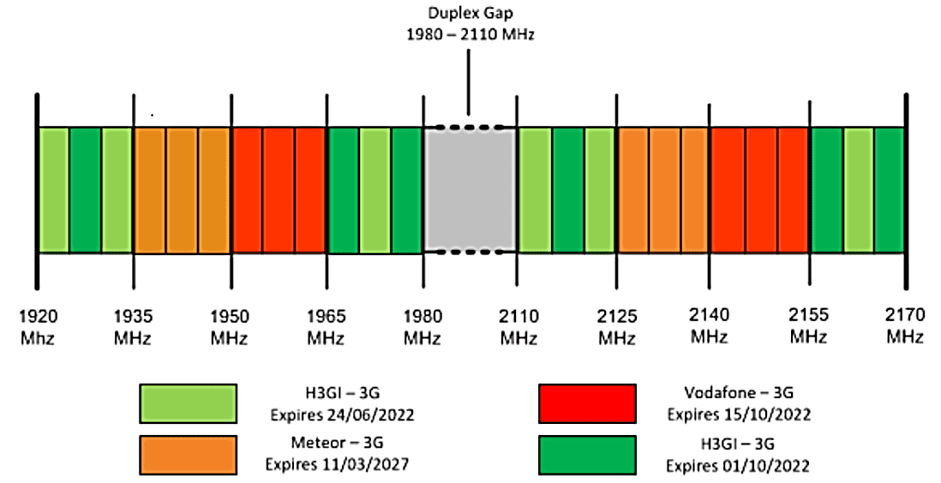

Image courtesy of ComReg 19/59R

The 2100 MHz band, which has comparable propagation characteristics to the aforementioned 2300 and 2600 MHz bands, is currently deployed exclusively for 3G services in Ireland. ComReg conducted auctions in 2002 and 2007 to award spectrum in the Paired 2.1 GHz FDD Band (1920-1980 MHz and 2110-2170 MHz) and the Unpaired 2.1 GHz TDD Band (1900-1920 MHz).

In light of current and future capacity demands, there is now a requirement to re-allocate spectrum within this band on a technology-agnostic basis. The mature device and equipment ecosystem for 4G LTE in the band will support this process and future deployments.

However, the inclusion of the 2100 MHz band in ComReg’s upcoming award process has not yet been finalised, and some mobile operators have urged for liberalisation at a later date. This is a consequence of the underlying licensing complexity within the band, which is broken into different expiration dates and “time slots” across each mobile operator.

Conclusion: A win-win for operators, consumers and the Irish economy.

The forthcoming spectrum auction in Ireland is arriving as a sea change sweeps across the wireless industry, enabling new frontiers of performance, but also intensifying pre-existing financial pressures. Standing still as the demand for network resources skyrockets is simply not an option.

Operators, consumers and the Irish economy alike is set to reap incalculable benefit from this spectrum auction, which is uniquely momentous in its inclusion of both coverage and capacity bands.

It is envisioned that the 700 MHz band will drive mass adoption of 5G NR and complement Ireland’s efforts to reduce the digital divide. In parallel, the 2300 and 2600 MHz bands will equip operators with radically enhanced network capacity, supporting the next wave of high-bandwidth applications and enabling the anticipated performance leap associated with 5G NR.

While an exact date has not yet been set in stone, the auction is likely to take place sometime between the end 2020/start 2021.

For more information please visit the ComReg website or contact us today.